Current Issues In Islamic Finance In Malaysia

According to the state of the islamic economy report 2018 19 malaysia has been the leader of the islamic economy ecosystem for five consecutive years since 2013.

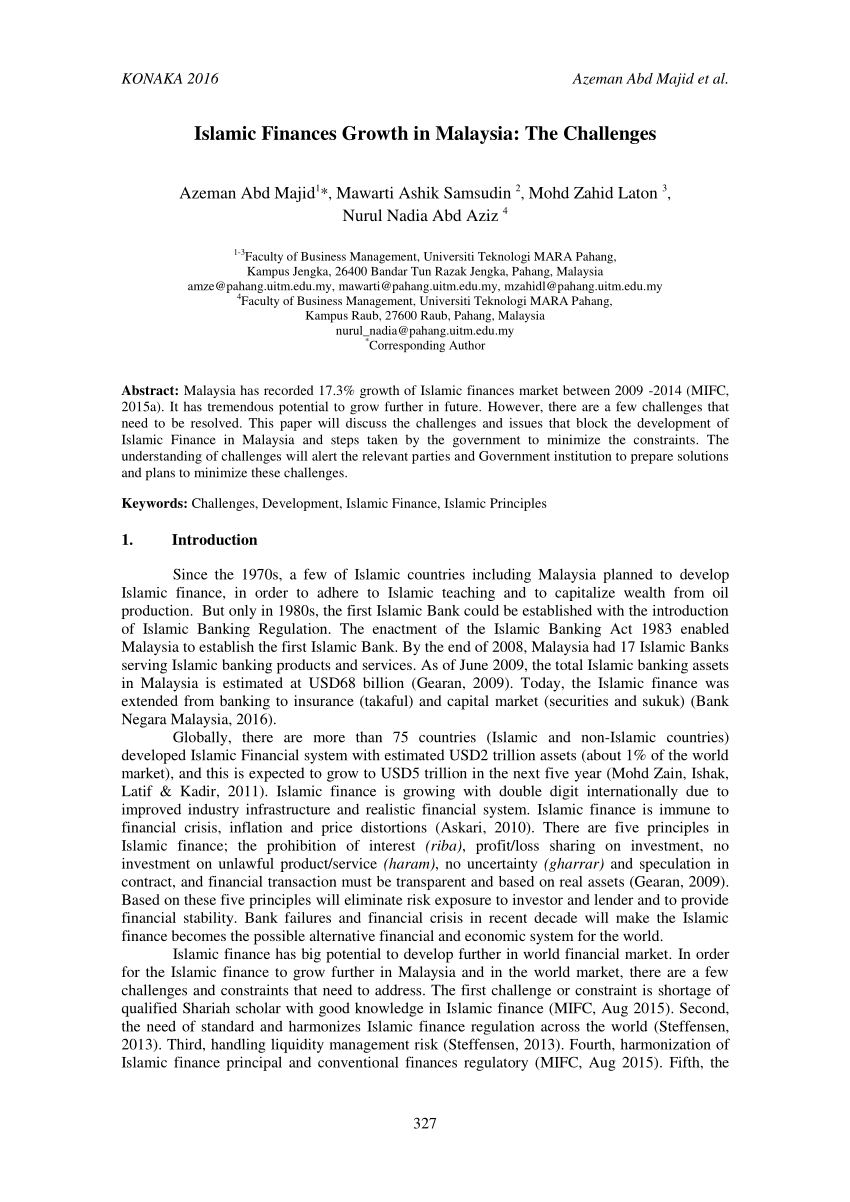

Current issues in islamic finance in malaysia. The study proclaimed asia as the largest market for both sukuk and islamic funds. Malaysia has recorded 17 3 growth of islamic finances market between 2009 2014 mifc 2015a. Bank rakyat said islamic finance if institutions need to rethink their roles for the current times and urged them to look at how they can help address issues faced by the world currently. In a statement bank rakyat chairman datuk noripah kamso had urged if stakeholders attending the international islamic shariah scholars roundtable ishar to go beyond the banking mindset.

Journey from equality to impoverishment. According to ram ratings malaysia was the top sukuk issuer with us 13 9 bil ringgit equivalent or 35 1 of the us 39 5 bil ringgit equivalent sukuk issued in the first quarter ended march 31 2019. But when it comes to the tech side of islamic fintech the picture is not quite so clear cut. Islamic tradition in economics.

One study of which modes of islamic finance were used most frequently found pls financing in leading islamic banks had declined from 17 34 in 1994 6 to. This is followed by a discussion on the features and principles of islamic finance. Bank aljazira records 29 31 decrease in net profit year on year for third quarter of 2020. Malaysia was named a leader in islamic finance producing 26 of the world s shariah compliant financial assets by the end of 2017 amounting to us 528 7 billion rm2 05 trillion.

Islamic banks at least in saudi arabia and egypt have departed from using profit loss sharing techniques as a core principle of islamic banking according to a 2006 dissertation by suliman hamdan albalawi malaysia has also seen a decline. It has tremendous potential to grow further in future. Welfare in the islamic finance. Islamization of finance sector.

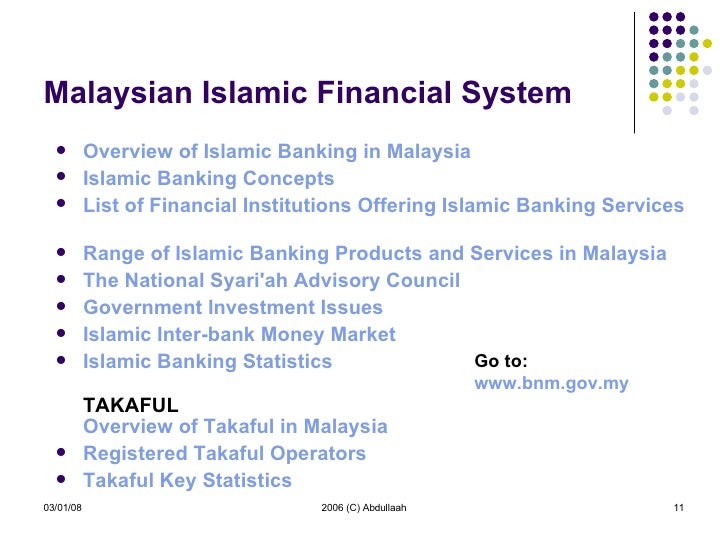

State bank of pakistan confirms reopening of government s sukuk ijarah with announcement of auction dates. Malaysia s islamic finance industry had existed for more than thirty 30 years continues to grow rapidly supported by conducive environment comprehensive financial structure and adopted global. Issues problems and strategy. Legislative changes in islamic finance.

The fourth section addresses the contemporary issues in islamic finance and the challenges faced by the industry in malaysia. The islamic finance industry in malaysia is characterised by having comprehensive market components ranging from islamic banking takaful islamic money market and islamic capital market.