Development Of Islamic Banking In Malaysia

9 3 outpacing that of conventional banking s 3 3 underpinned by the banks.

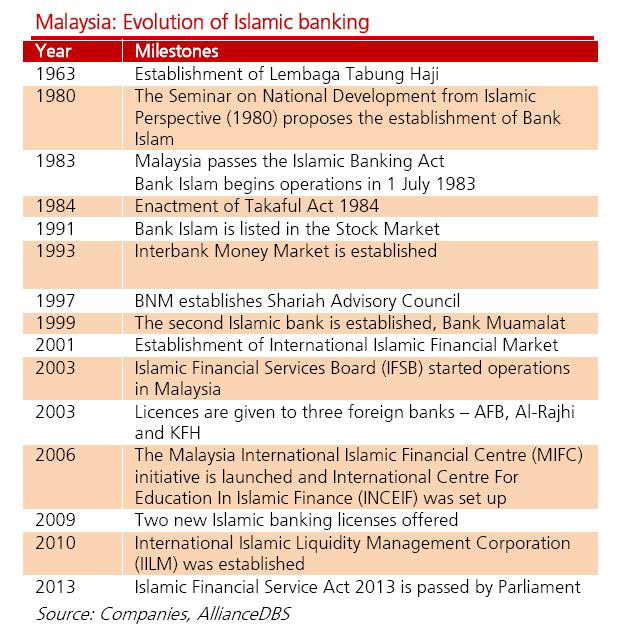

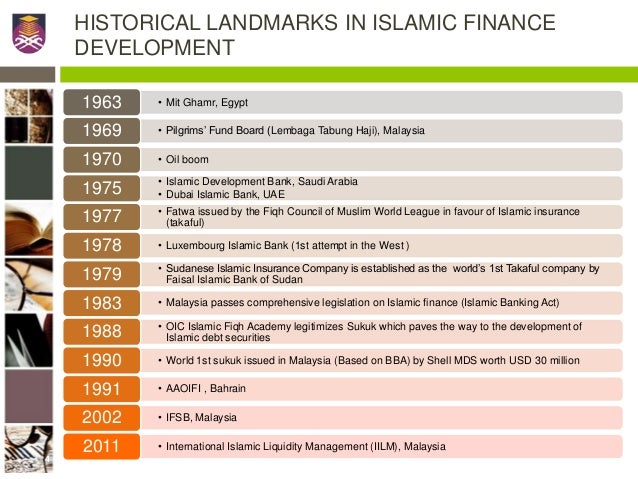

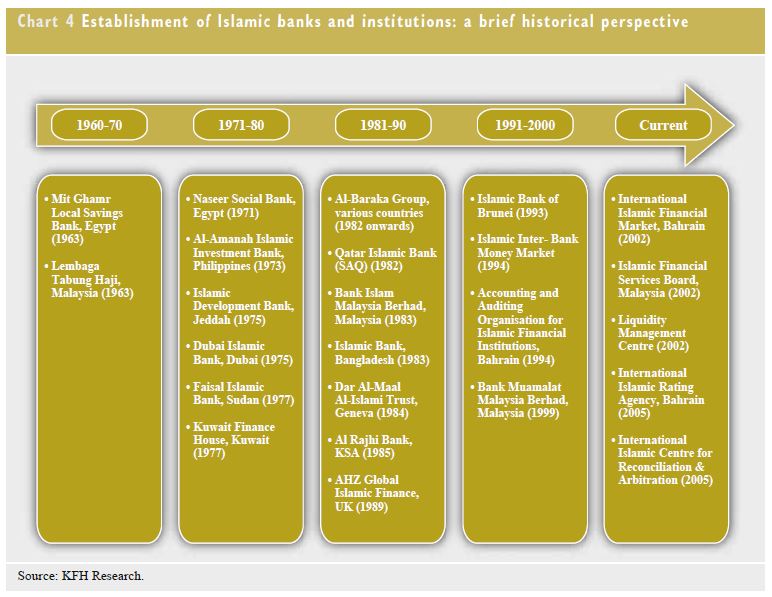

Development of islamic banking in malaysia. Pwsbh was set up as an institution for muslims to save for their hajj pilgrimage to mecca expenses in 1969 pwsbh merged with pejabat urusan haji to form lembaga urusan dan tabung haji now known as lembaga tabung haji. What are dfis the dfis in malaysia are specialised financial institutions established by the government with specific mandate to develop and promote key sectors that are considered of strategic importance to the overall socio economic development objectives of the country. Malaysia s a stable islamic banks financing grew by 11 in 2018 2017. Are bank perusahaan kecil dan ant sederhana malaysia berhad sme bank export import bank of malaysia berhad agro bank formerly known as bank pertanian malaysia and bank simpanan nasional i ter berhad 29 as far as their islamic banking services are.

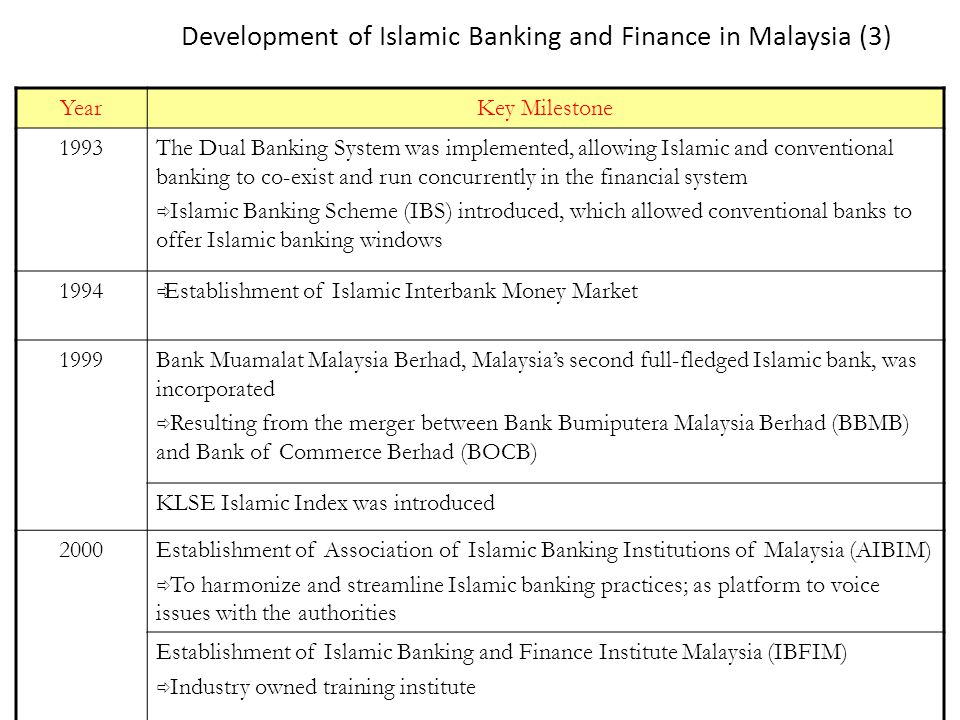

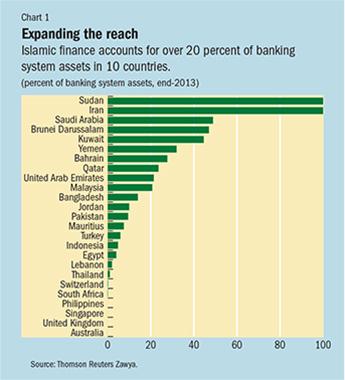

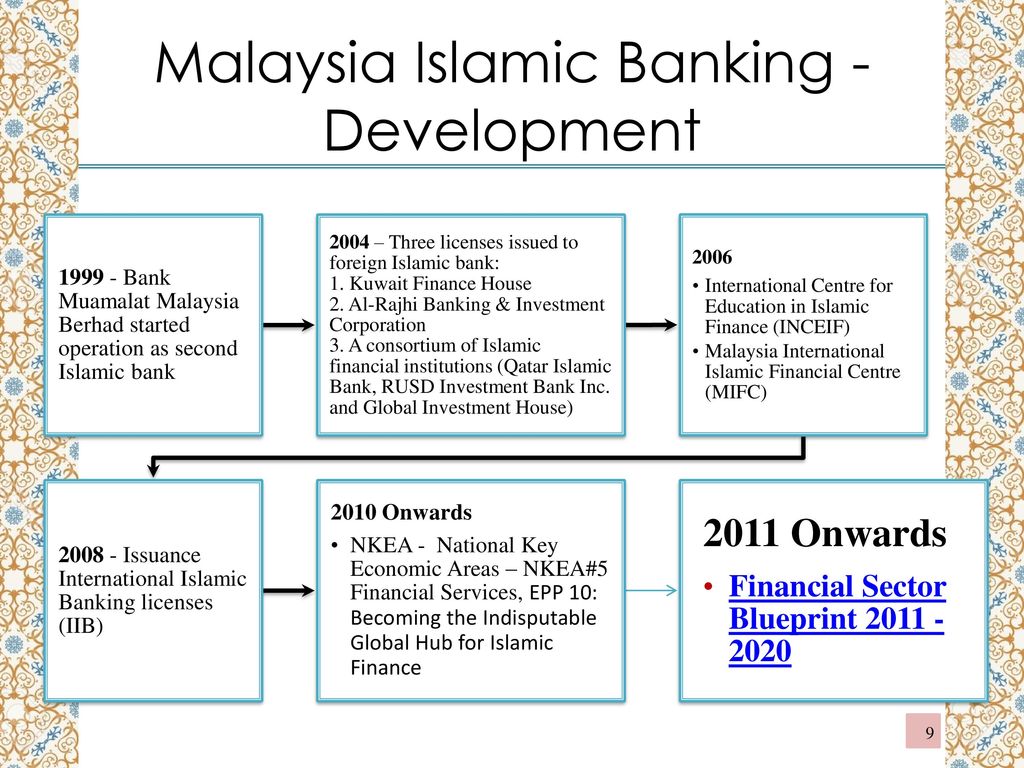

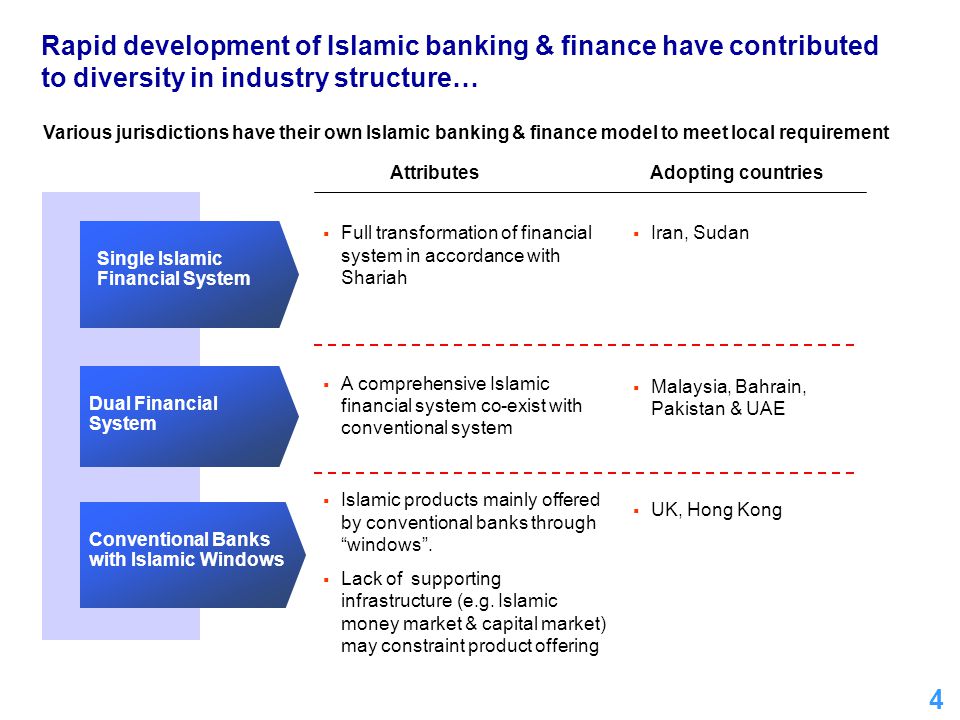

In 2008 islamic banking accounted for 7 1 per cent of malaysia s financial sector. The islamic banking and finance industry in malaysia is developing progressively primarily due to the concerted effort from the regulators and the industry players alike. Islamic banking being a new thing and the customers being accustomed to conventional banking it was natural that they thought of it in the light of what they were accustomed to. The icm functions as a parallel market to the conventional capital market and plays a complementary role to the islamic banking system in broadening and deepening the islamic financial markets in malaysia.

It plays an important role in generating economic growth for the country. Lof other development financial institutions offering islamic banking services other nic than the bank kerjasama rakyat malaysia sdn. This paper will focus on the historical development of islamic banking in malaysia from the creation of the haj pilgrim s fund board in the 1960s to the current islamic banking scene of 17. From a market share of 5 3 in 2000 islamic financing now accounts for 34 9 of total loans and financing.

The first product introduced in islamic banking in malaysia for financing purchases of houses and cars the most common items was bai bithaman ajil bba. By 2016 that figure had leapt to 28 per cent and the malaysian government hopes to push it over 40 per cent by 2020. Islamic banking in malaysia began in september 1963 when perbadanan wang simpanan bakal bakal haji pwsbh was established.