Income Tax Brackets Malaysia

Calculations rm rate tax rm 0 5 000.

Income tax brackets malaysia. Personal income tax rates. An individual whether tax resident or non resident in malaysia is taxed on any income accruing in or derived from malaysia. What is tax rebate. The following rates are applicable to resident individual taxpayers for ya 2020.

Inland revenue board of malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this website. As expatriates may fall into either tax category it is important to understand malaysia s basic tax structure. Tax administration diagnostic assessment tool tadat association of tax authorities in islamic countries ataic perundangan. The deadline for filing income tax in malaysia is 30 april 2019 for manual filing and 15 may 2019 via e filing.

Now that you re up to speed on whether you re eligible for taxes and how the tax rates work let s get down to the business of actually filing your taxes. Taxable income myr tax on column 1 myr. Non resident individuals pay tax at a flat rate of 30 with effect from ya 2020. Tax relief for year of assessment 2019 tax filed in 2020 chapter 5.

Malaysia income tax e filing guide. How does monthly tax deduction mtd pcb work in malaysia. On the first 5 000 next 15 000. The income tax act of 1967 structures personal income taxation in malaysia while the government s annual budget can change the rates and variables for an individual s taxation.

These proposals will not become law until their enactment and may be amended in the course of their passage through. Home income tax rates. Below are the individual personal income tax rates for the year of assessment 2019 provided by the the inland revenue board irb lembaga hasil dalam negeri lhdn malaysia. You can file your taxes on ezhasil on the lhdn website.

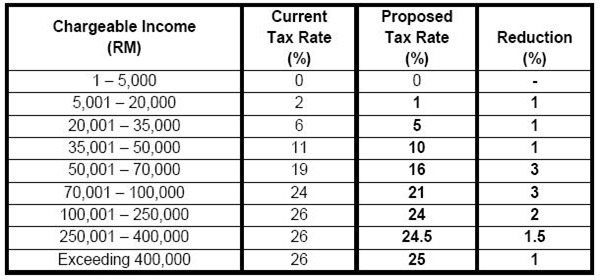

This publication is a quick reference guide outlining malaysian tax information which is based on taxation laws and current practices. Tax rates for year of assessment 2019 tax filed in 2020 chapter 6. This booklet also incorporates in coloured italics the 2020 malaysian budget proposals announced on 11 october 2019 and the finance bill 2019. What is income tax return.

How to pay income. According to lhdn foreigners employed in malaysia must give notice of their chargeability to the non resident branch or nearest lhdn branch within 2 months of their arrival in malaysia. Malaysia personal income tax rate. Ibu pejabat lembaga hasil dalam negeri malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor.

The personal income tax rates for 2018 2019 have been restructured and are different from previous year s rates. On the first 5 000.