Income Tax Rate Malaysia 2020 For Non Resident

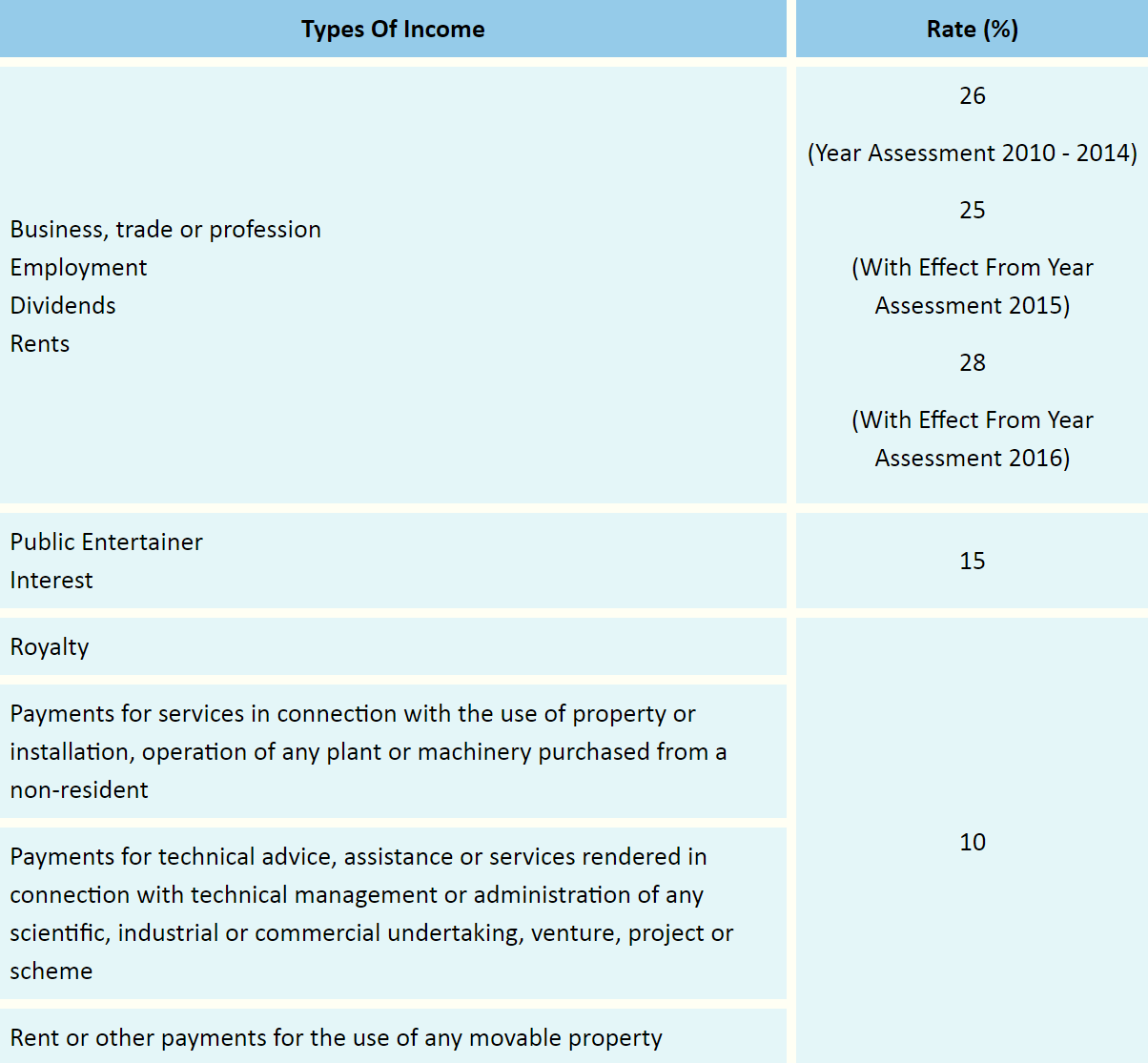

Non resident individual is taxed at a different tax rate on income earned received from malaysia.

Income tax rate malaysia 2020 for non resident. Inland revenue board of malaysia shall not be liable for any loss or damage caused by the usage of any information. On the first 5 000. Resident company other than company described below 24. Non resident individual is taxed at a different tax rate on income earned received from malaysia.

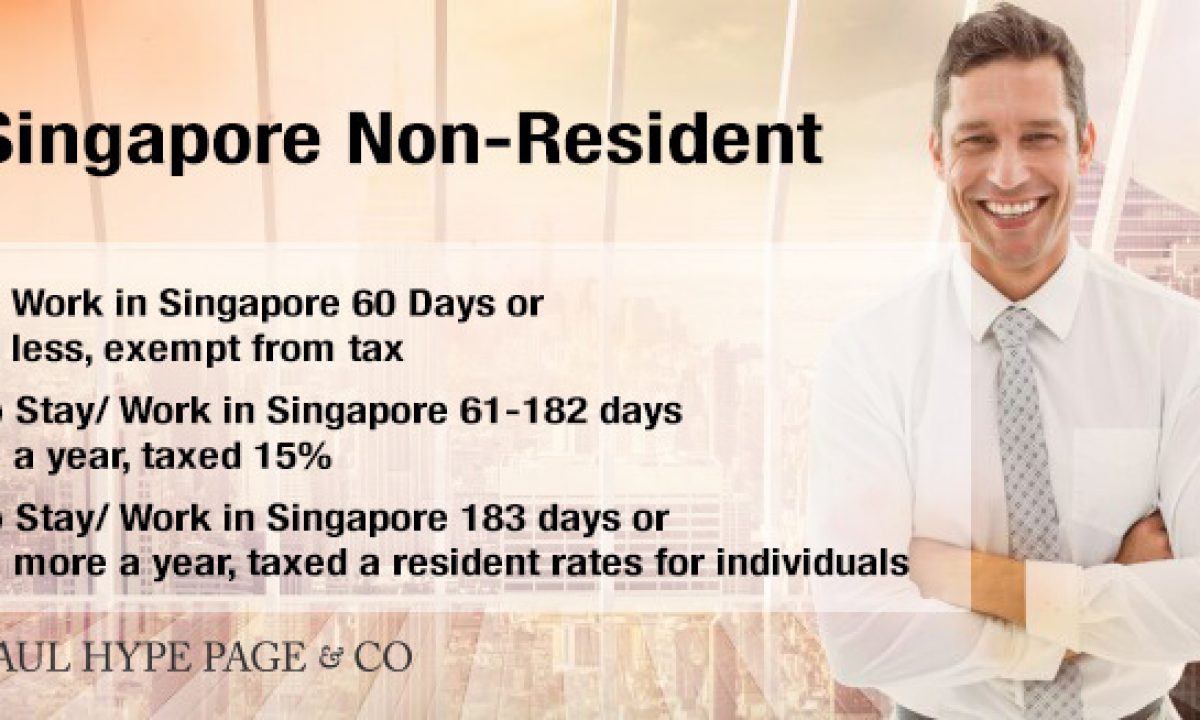

For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing. Residents and non resident status will give a different tax regime on income earned received from malaysia. So it is very important to identify whether you are residents or non resident in regard to malaysia tax law. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020.

Frequently asked question individual company. Meanwhile for the b form resident individuals who carry on business the deadline is 15 july for e filing and 30 june for manual filing. 2019 2020 malaysian tax booklet this publication is a quick reference guide outlining malaysian tax information which is based on taxation laws and current practices. Calculations rm rate tax rm 0 5 000.

You are non resident under malaysian tax law if you stay less than 182 days in malaysia in a year regardless of your citizenship or nationality. Green technology educational services. Non resident individuals pay tax at a flat rate of 30 with effect from ya 2020. This booklet also incorporates in coloured italics the 2020 malaysian budget proposals announced on 11 october 2019 and the finance bill 2019.

The current cit rates are provided in the following table. A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g. For both resident and non resident companies corporate income tax cit is imposed on income accruing in or derived from malaysia. Chargeable income myr cit rate for year of assessment 2019 2020.

You are non resident under malaysian tax law if you stay less than 182 days in malaysia in a year regardless of your citizenship or nationality. Malaysia personal income tax rate.