Income Tax Rate Malaysia Calculator

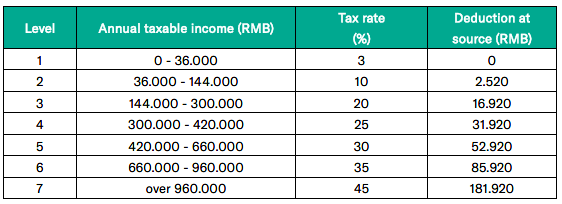

This means that low income earners are imposed with a lower tax rate compared to those with a higher income.

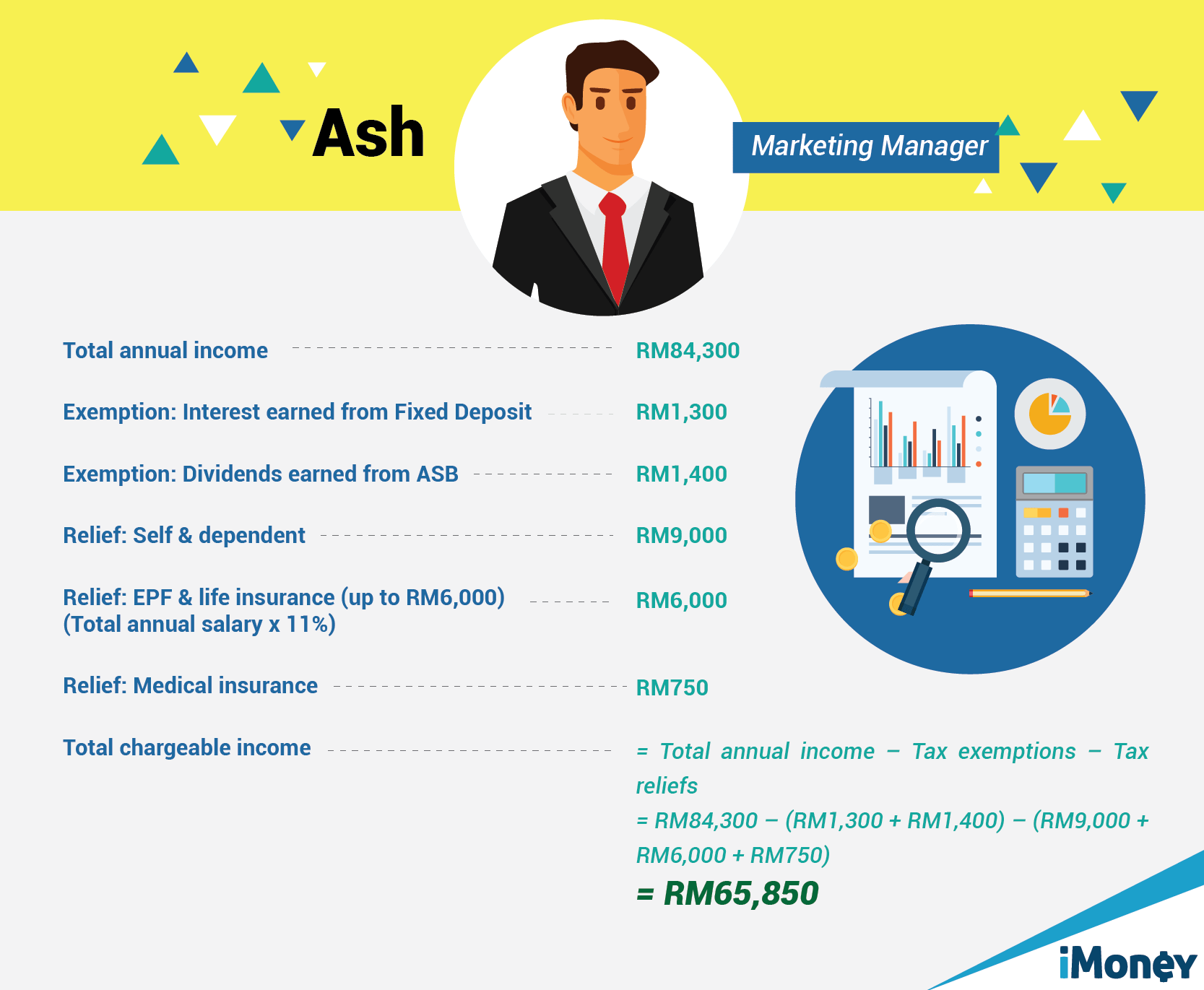

Income tax rate malaysia calculator. Malaysia income tax e filing guide. Malaysia personal income tax calculator for ya 2020 malaysia adopts a progressive income tax rate system. Tax rates for year of assessment 2019 tax filed in 2020 chapter 6. Calculate your income tax in malaysia salary deductions in malaysia and compare salary after tax for income earned in malaysia in the 2020 tax year using the malaysia salary after tax calculators.

The acronym is popularly known for monthly tax deduction among many malaysians. About simple pcb calculator pcb calculator made easy. How to pay income tax in malaysia. Your average tax rate is 15 12 and your marginal tax rate is 22 50 this marginal tax rate means that your immediate additional income will be taxed at this rate.

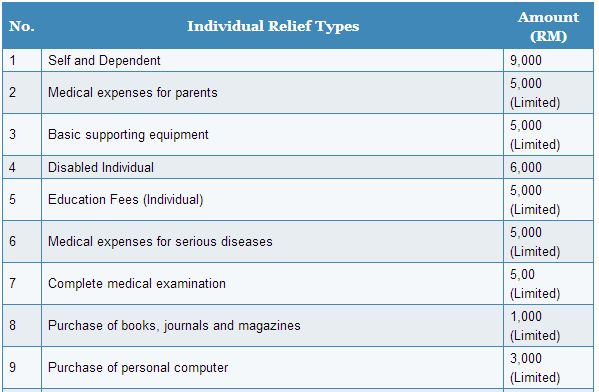

Below are the individual personal income tax rates for the year of assessment 2019 provided by the the inland revenue board irb lembaga hasil dalam negeri lhdn malaysia. If you need to check total tax payable for 2019 just enter your estimated 2019 yearly income into the bonus field leave salary field empty and enter whatever allowable deductions for current year to calculate the total amount of tax for current year. What is tax rebate. Pcb stands for potongan cukai berjadual in malaysia national language.

Income tax rates 2020 malaysia. Select a tax calculator from the list below that matches how you get paid or how your salary package is detailed. The personal income tax rates for 2018 2019 have been restructured and are different from previous year s rates. According to section 45 of malaysia s income tax act 1967 all married couples in malaysia have the right to choose whether to file individual or joint taxes.

Simple pcb calculator is a monthly tax deduction calculator to calculate income tax required by lhdn malaysia. Malaysia taxpayer s responsibilities. If you make rm 70 000 a year living in malaysia you will be taxed rm 10 582 that means that your net pay will be rm 59 418 per year or rm 4 952 per month. How does monthly tax deduction mtd pcb work in malaysia.

What is income tax return. As a general rule of thumb if both spouses are earning high incomes in the year of assessment it is always recommended to opt for separate assessment to leverage on the tax reliefs and deductibles available.