Lhdn Benefit In Kind 2017

Where a motorcar is provided the benefit to be assessed is the.

Lhdn benefit in kind 2017. These also count towards part of your income. The benefits should be available to all staff in order to achieve the objective of fostering good relationship among the staff and it is difficult to assign a specific value to each employee. And one should also be awar. Whichever method is used in determining the value of the benefit provided the basis of computing the benefit whether the formula method or the prescribed value method must be consistently applied throughout the period of the provision of the benefit.

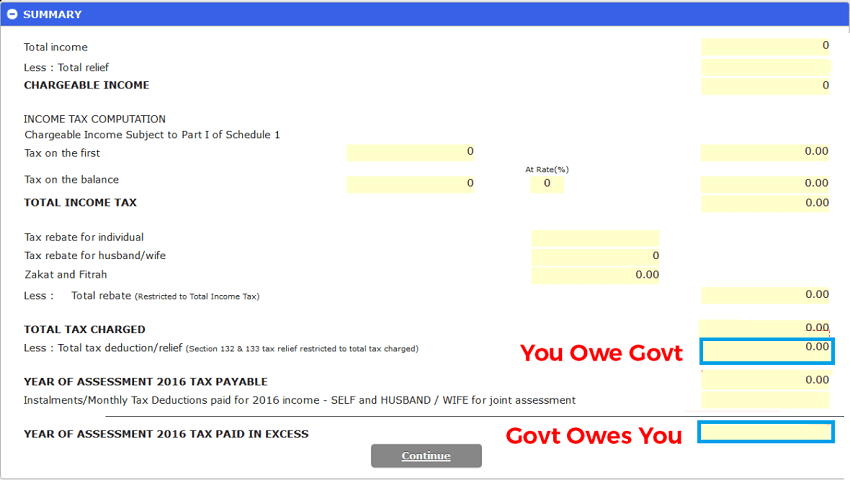

There are two ways to determine the monetary thus taxable value of these benefits. Benefits that foster goodwill or promote camaraderie among staff. The formula method which uses this calculation. Employees responsibilities 23 11 monthly tax deduction 23 12.

Motorcar and other related benefits 7 1 1. These benefits in kind are mentioned in paragraphs 4 3 and 4 4 of the public ruling no. There are several tax rules governing how these benefits are valued and reported for tax purposes. The basis of computing the benefit whether the formula method or the prescribed value method must be consistently applied throughout the period of the provision of the benefit.

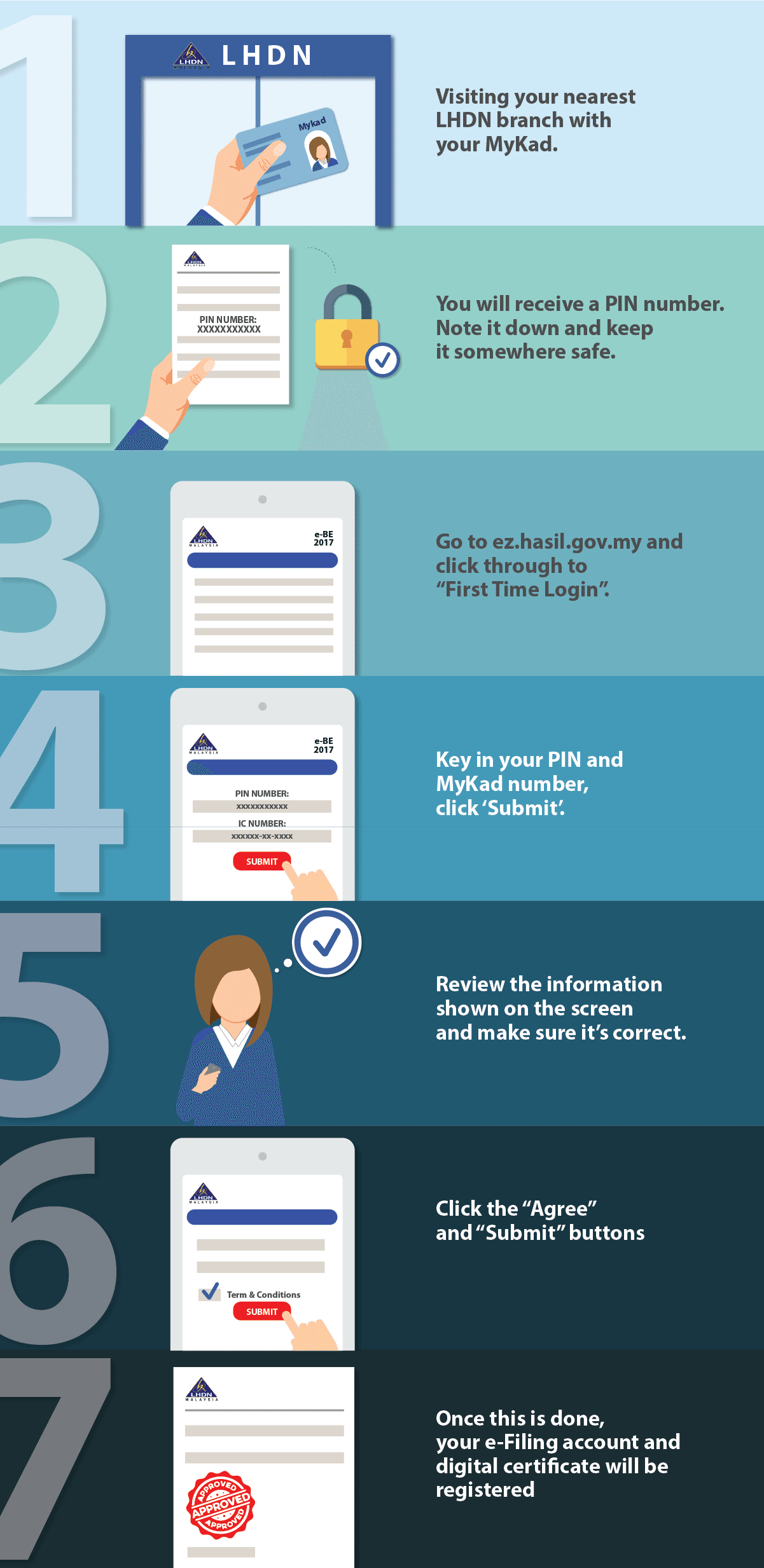

2 2004 issued on 8 november 2004. As the clock ticks for personal income tax deadline in malaysia 2018 like gainfully employed malaysians you may have started visiting the lhdn malaysia website to do your e filing as both a proactive and precautionary measure. Employer s responsibilities 22 10. Particular benefit in kind 7 1.

Tax exemption on benefits in kind received by an employee 14 9. Particulars of benefits in kind 4 7. Think of these as perks but ones that cannot be directly converted to cash. Types of benefits comments.

Other benefits 14 8. Deduction claim 24 13. Benefits in kind 2 5. Value of asset lifespan of asset annual value of benefit.

2 2 however there are certain benefits in kind which are either exempted from tax or are regarded as not taxable. Motorcar and other related benefits 7 1 1. These benefits are called benefits in kind bik. Generally non cash benefits e g.

A further clarification on benefits in kind in the form of goods and services offered at discounted prices. Particular benefit in kind 7 1.