Example Of Direct Tax In Malaysia

Section 138a of the income tax act 1967 ita provides that the director general of inland revenue is empowered to make a public ruling in relation to the application of any provisions of the ita.

Example of direct tax in malaysia. The tax is paid directly to the government. A public ruling is published as a guide for the public and officers of the inland revenue board of malaysia. Service tax is levied on prescribed taxable services while many goods are exempt from sales tax. Since the repeal of the goods and services tax gst and the implementation of sales and service tax sst indirect tax risk has never been higher.

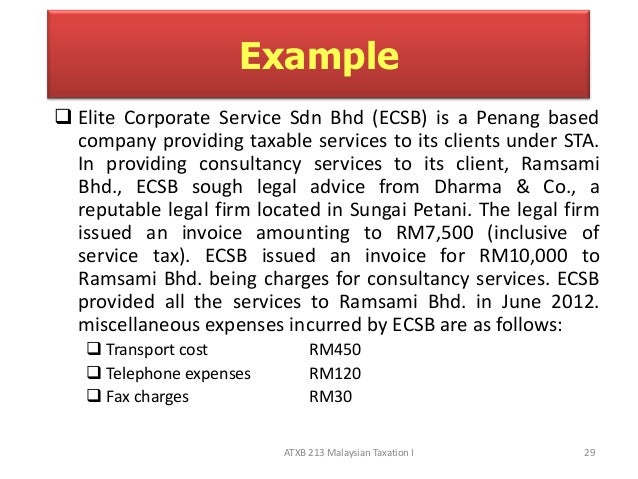

A direct tax is a tax that is levied on a person or company s income and wealth. One such example is the double tax treaty between malaysia and south africa known as the double taxation relief the government of the republic of south africa order 2005 south africa order which specifies that the benefits of the south africa order shall not be made available in relation to the carrying on of any offshore business activities as defined in the lbata as at 26 july 2005. Sales tax and service tax were implemented in malaysia on 1 september 2018 replacing goods and services tax gst. Type of indirect tax.

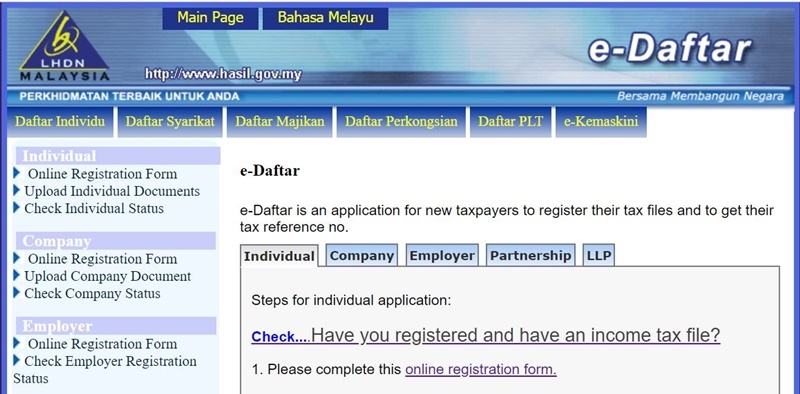

The most common tax reference types are sg og d and c. The inland revenue board of malaysia malay. Your income tax number consists of a tax reference type of 1 or 2 letter code followed by a 10 or 11 digit tax reference number. Every individual in malaysia including resident or non resident who is liable to tax is required to declare his income to inland revenue board of malaysia irbm or lembaga hasil dalam negeri malaysia ldhn.

Lembaga hasil dalam negeri malaysia classifies each tax number by tax type. The statutory body who is in charged with the direct tax is the malaysia inland revenue board lhdn. Taxpayer is responsible to submit income tax return form itrf and make income tax payment yearly prior to due date. Dated 7 july 2017 for tax incentives to promote the establishment of principal hubs in malaysia.

Examples of direct tax are income tax and real property gains tax. Price control and anti profiteering pcap conduct training for businesses on the pcap regulations and the impact it may have in determining pricing policy. Meanwhile indirect tax is referred to as tax. What supplies are liable to the standard rate.

10 for sales tax and 6 for service tax. A principal hub is a company incorporated in malaysia and that uses malaysia as a base for conducting its regional and global businesses and operations to manage control and support its key functions.