Personal Income Tax Rate Malaysia

Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file.

Personal income tax rate malaysia. Tax rates for year of assessment 2019 tax filed in 2020 chapter 6. According to lhdn foreigners employed in malaysia must give notice of their chargeability to the non resident branch or nearest lhdn branch within 2 months of their arrival in malaysia. What is tax rebate. This means that low income earners are imposed with a lower tax rate compared to those with a higher income.

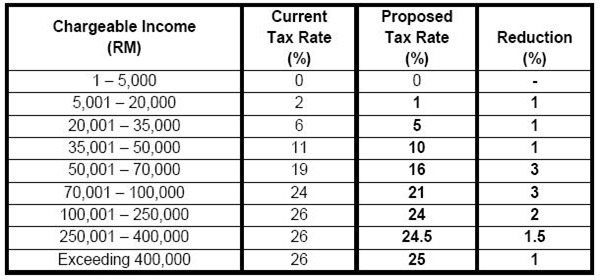

Understanding tax rates and chargeable income. Here are the income tax rates for personal income tax in malaysia for ya 2019. Malaysia personal income tax calculator for ya 2020 malaysia adopts a progressive income tax rate system. Malaysia personal income tax rate.

Income tax rates 2020 malaysia. Personal income tax rate in malaysia averaged 27 29 percent from 2004 until 2020 reaching an all time high of 30 percent in 2020 and a record low of 25 percent in 2015. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020. Average lending rate bank negara malaysia schedule section 140b restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research sgatar.

There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make sure you. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. The personal income tax rates for 2018 2019 have been restructured and are different from previous year s rates. Below are the individual personal income tax rates for the year of assessment 2019 provided by the the inland revenue board irb lembaga hasil dalam negeri lhdn malaysia.

What is chargeable income. Green technology educational services. What is a tax deduction. The personal income tax rate in malaysia stands at 30 percent.

Tax relief for year of assessment 2019 tax filed in 2020 chapter 5. This page provides malaysia personal income tax rate actual values historical data forecast chart statistics economic calendar and news. Malaysia personal income tax guide for 2020. With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income.

Non resident individuals pay tax at a flat rate of 30 with.