Bursa Suq Al Sila

Byrsa bank of afghanistan afghanistan.

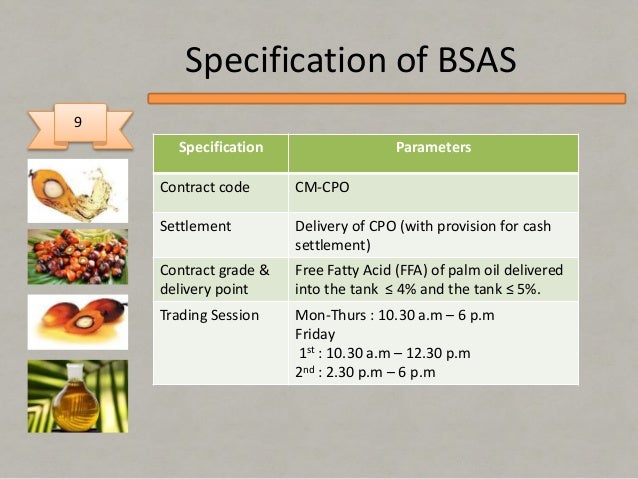

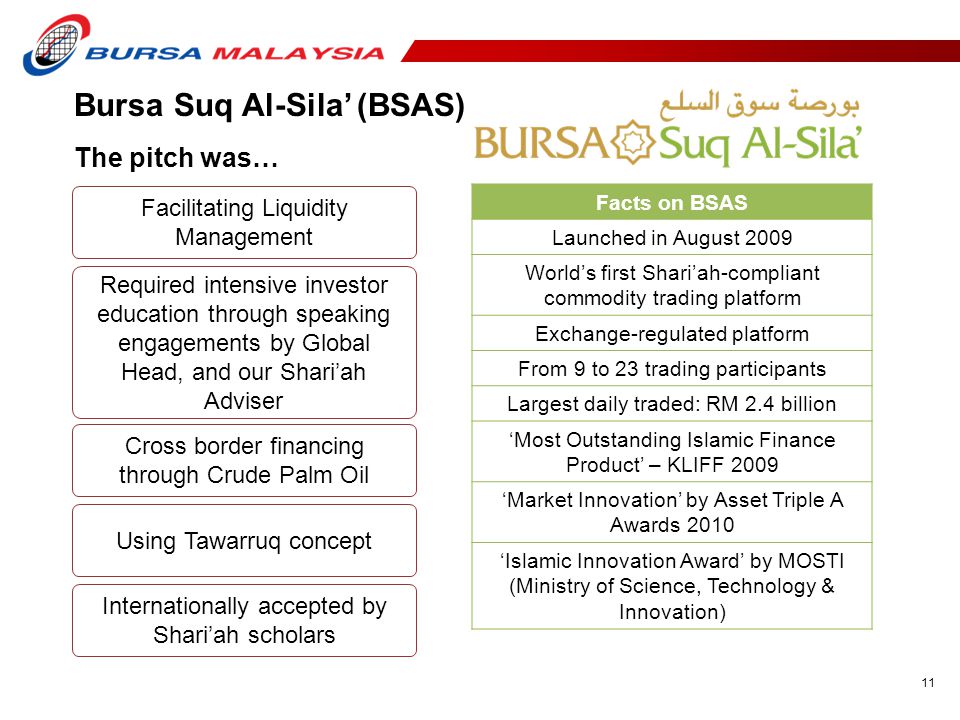

Bursa suq al sila. Platform pengurusan kecairan tunai mekanisme bursa suq al sila adalah berteraskan konsep murabahah dan tawarruq. Bmis a wholly owned subsidiary of bursa malaysia which is regulated transparent and fully shariah compliant. All businesses and activities of bsas are managed by bursa malaysia islamic services sdn. Bursa suq al sila bsas bursa malaysia market.

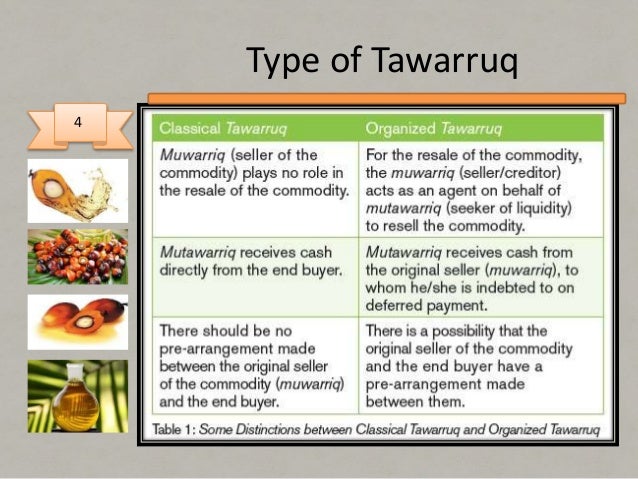

Pelanggan yang memerlukan pembiayaan menghubungi pihak bank. It was an awesome program. Bursa suq al sila bsas adalah himpunan daripada perkataan bahasa arab iaitu bursah yang bermaksud platform suq yang bermaksud pasaran dan al sila yang bermaksud komoditi. Secara umumnya bsas berperanan sebagai platform yang menjalankan urus niaga perdagangan komoditi terutamanya dalam transaksi perbankan yang melibatkan kontrak tawarruq atau commodity murabahah.

What is bursa al sila. A hybrid market offering members a choice of trading electronically through a secured web based system or through traditional voice broking. The world s first multi commodity and multi currency. Expected later this month.

Bank mendapatkan persetujuan pelanggan mengenai fasiliti pembiayaan yang dikehendaki misalnya rm100 000 00 bank menyertai platform bursa suq al sila dengan membeli komoditi dengan nilai rm100 000 00 daripada pembekal a. Model bursa suq al sila telah mendapat kelulusan majlis penasihat syariah suruhanjaya sekuriti pada 5 februari 2008 dan majlis penasihat syariah bank negara malaysia pada 30 julai 2008. Mekanisme transaksi bursa suq al sila adalah seperti berikut. Pakistan considering privately placed year sukuk.

Congratulations to all participants. Bursa suq al sila bsas is a commodity trading platform specifically dedicated to facilitate islamic liquidity management and financing by islamic financial institutions. Bursa suq al sila is indeed one of its kind as it is the worlds first shariah compliant commodity trading platform specifically designed to facilitate islamic finance. Shariah compliant platform to support murabahah transactions.